Member-only story

Advanced Risk Management Techniques Using Monte Carlo Simulations in Python

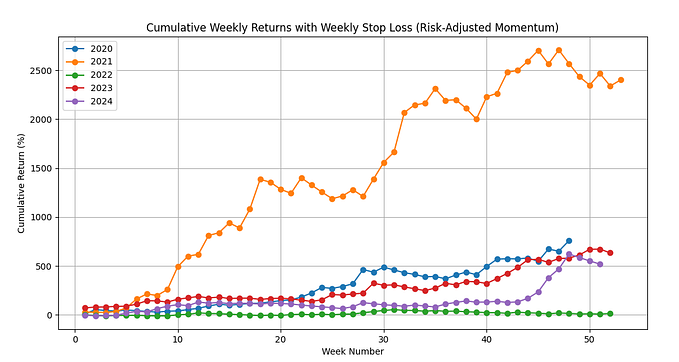

Risk management is a crucial aspect of any investment strategy, especially in the volatile world of financial markets. One powerful tool that can help investors assess and mitigate risks is Monte Carlo simulation. In this tutorial, we will explore advanced risk management techniques using Monte Carlo simulations in Python. We will leverage the yfinance library to download real financial data and demonstrate how Monte Carlo simulations can be used to analyze and manage risks in investment portfolios.

Monte Carlo simulation is a statistical technique that allows us to model the probability of different outcomes in a process that involves randomness or uncertainty. In the context of finance, Monte Carlo simulations can be used to simulate the potential future performance of an investment portfolio based on historical data and various assumptions. By running thousands or even millions of simulations, we can gain insights into the range of possible outcomes and make more informed decisions about risk management.

To begin our tutorial, let’s first install the necessary libraries. We will use yfinance to download financial data, numpy for numerical computations and matplotlib for plotting the simulation results. Run the following shell commands to install the required libraries:

pip install yfinance numpy matplotlibNow, let’s import the libraries and set up our Python environment:

import yfinance as yf

import numpy as np

import matplotlib.pyplot as plt

# Set the random seed for reproducibility

np.random.seed(42)Next, we will download historical stock price data for a diverse set of assets from Yahoo Finance using the yfinance library. We will select assets from different sectors to create a well-diversified portfolio. Let’s download the data for assets such as Tesla (TSLA), Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) until the end of February 2024:

assets = ['TSLA', 'AMZN', 'MSFT', 'GOOGL']

data = yf.download(assets, start='2020-01-01', end='2024-02-29')['Adj Close']Now that we have our financial data, we can proceed to calculate the daily returns of each asset. Daily returns are essential for simulating the…